- A person with $30,000 in student loans is 11 percent less likely to start a business than a person who graduated debt-free, according to calculations by Karthik Krishnan, an associate professor of finance at Northeastern University who researches student debt.

- “It’s going to be a big problem as we get to the next decade,” Krishnan said. “We’re going to see a gradual deterioration in outcomes in economic mobility and start-up activity.”

Small business owners can be especially hurt by the effects of student debt, according to a study by researchers at the Federal Reserve Bank of Philadelphia and Pennsylvania State.

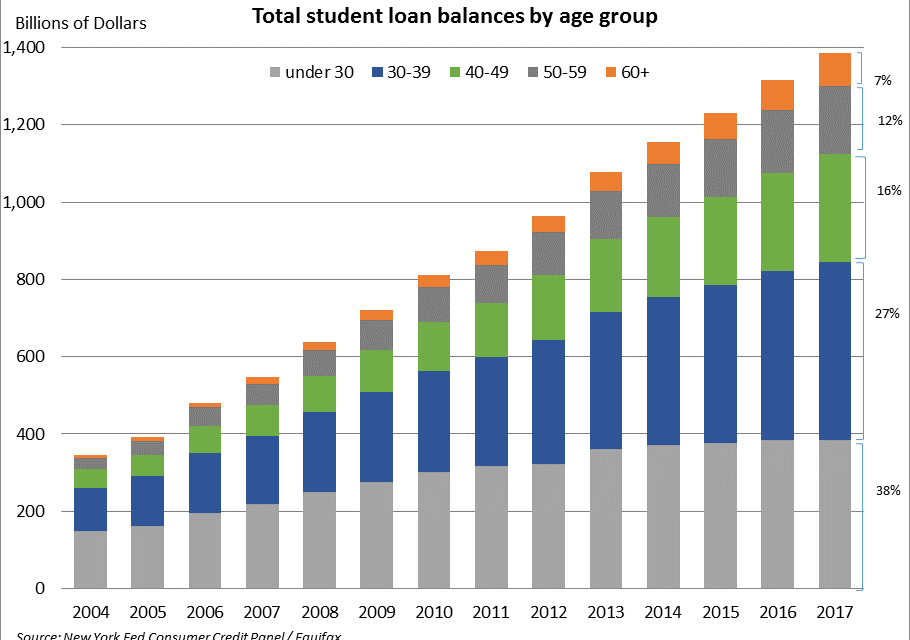

As student debt outpaces credit card and auto debt, the number of businesses with one to four employees dropped by 14 percent between 2000 and 2010, the researchers found.

The consequences of this trend could reverberate throughout the economy, said Brent W. Ambrose, the Smeal Professor of risk management at Pennsylvania State University and a co-author of the study.

“A large percentage of employment in the United States comes from small businesses,” Ambrose said. “If student debt is causing a reduction in the ability to create these new businesses, that could be a problem.”

How to start a business with student debt

Often, new business owners make little or no money for themselves while they’re working to get their venture off the ground, said Mark Kantrowitz, publisher of SavingForCollege.com. Therefore, they should see if they qualify for a deferment or forbearance, temporary postponements of their student loan payments. (Keep in mind, this might result in your debt growing due to interest accruing.)

“Entrepreneurs should also consider income-driven repayment plans, which base the monthly payment on your income, as opposed to the amount you owe,” Kantrowitz said.

To raise money for your business, Kantrowitz recommended using crowdfunding platforms such as Kickstarter, Indiegogo or GoFundMe. You might also consider asking relatives for help, or pursuing angel investors or business accelerators, he added.

People who want to start a business should “live like a founder,” said Noam Wasserman, the author of Life is a Startup. Find the discipline, he said, to keep your expenses low, save money and pay down your debt. He said one of his students lived on a friend’s couch instead of renting an apartment to pay off her student debt.

Once your business is taking off, be sure to make at least the minimum payment every month on your student loans to avoid penalties and to protect your credit score, said Kimberly Palmer, personal finance expert at NerdWallet.

New business making life hectic? “You can set up the payment as an automatic draft from your bank account so you don’t have to worry about missing it by mistake,” Palmer said.

Nerdwallet and the Small Business Administration also have tips on how to start a business with student debt.

Facebook Comments